Full resolution (TIFF) - On this page / på denna sida - S - skatteinnehållningsbevis ...

<< prev. page << föreg. sida << >> nästa sida >> next page >>

Below is the raw OCR text

from the above scanned image.

Do you see an error? Proofread the page now!

Här nedan syns maskintolkade texten från faksimilbilden ovan.

Ser du något fel? Korrekturläs sidan nu!

This page has been proofread at least once.

(diff)

(history)

Denna sida har korrekturlästs minst en gång.

(skillnad)

(historik)

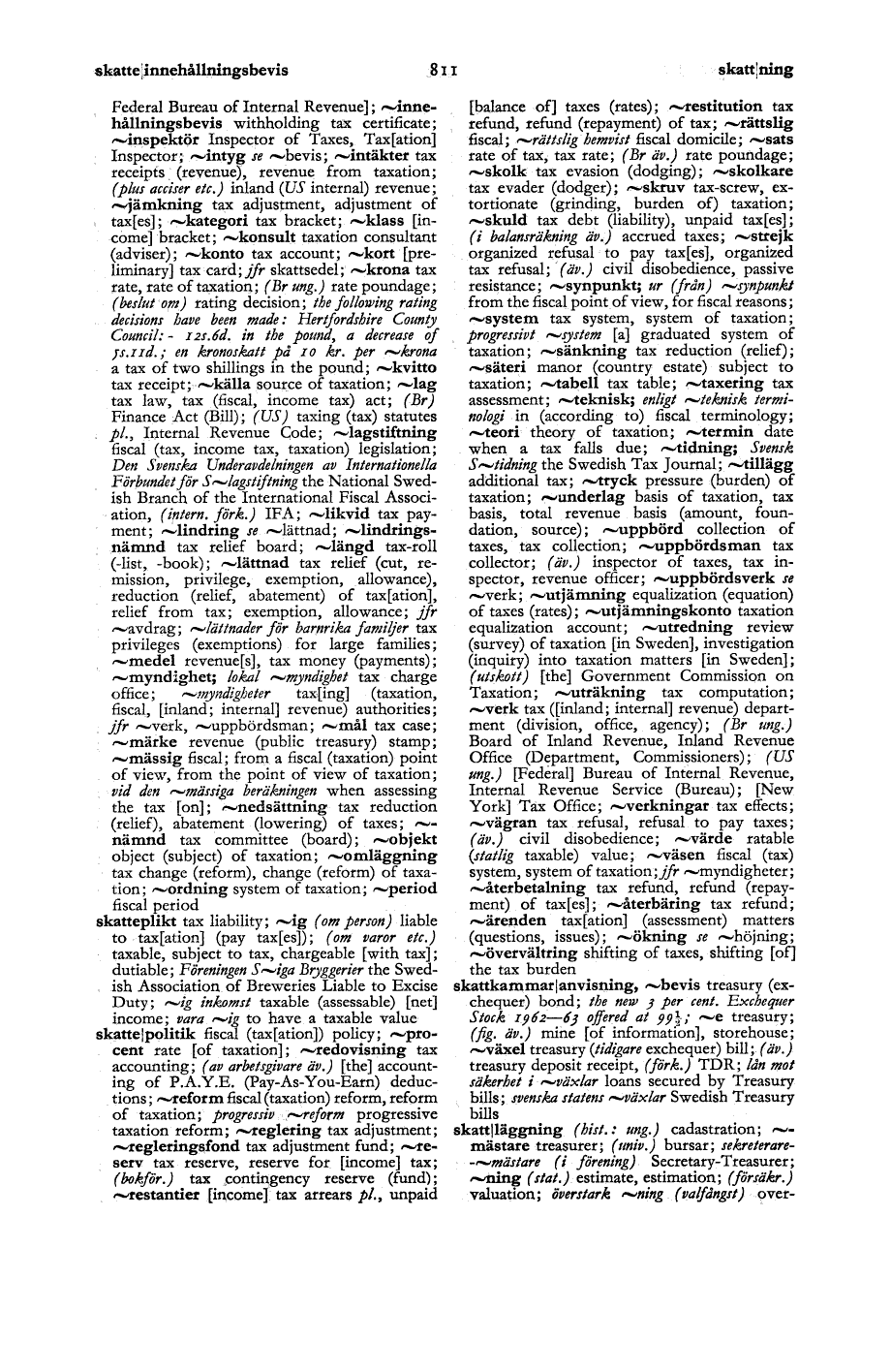

skatte|innehållningsbevis 811 skattning

Federal Bureau of Internal Revenue];

~inne-hållningsbevis withholding tax certificate;

~inspektör Inspector of Taxes, Tax[ation]

Inspector; ~intyg se ~bevis; ~intäkter tax

receipts (revenue), revenue from taxation;

(plus acciser etc.) inland (US internal) revenue;

~jämkning tax adjustment, adjustment of

tax[es]; okategori tax bracket; ~klass [-[income]-]

bracket; ~konsult taxation consultant

(adviser); ~konto tax account; ~kort [-[preliminary]-]

tax card; jfr skattsedel; ~krona tax

rate, rate of taxation; (Br ung.) rate poundage;

(beslut om) rating decision; the following rating

decisions have been made: Hertfordshire County

Council: - I2s.6d. in the pound, a decrease of

j s.i id.; en kronoskatt pd io kr. per ~ krona

a tax of two shillings in the pound; ~kvitto

tax receipt; ~källa source of taxation; ~lag

tax law, tax (fiscal, income tax) act; (Br)

Finance Act (Bill) ; (US) taxing (tax) statutes

pl., Internal Revenue Code; ~lagstiftning

fiscal (tax, income tax, taxation) legislation;

Den Svenska Underavdelningen av Internationella

Förbundet för S~lagstiftning the National

Swedish Branch of the International Fiscal

Association, (intern, förk.) IFA; olikvid tax

payment; ~lindring se ~lättnad;

~lindrings-nämnd tax relief board; ~längd tax-roll

(-list, -book); ~lättnad tax relief (cut,

remission, privilege, exemption, allowance),

reduction (relief, abatement) of tax[ation],

relief from tax; exemption, allowance; jfr

~avdrag; ~ lättnader för barnrika familjer tax

privileges (exemptions) for large families;

~medel revenue[s], tax money (payments);

~myndighet; lokal ~ myndighe ~ tax charge

office; ~myndigheter tax[ing] (taxation,

fiscal, [inland; internal] revenue) authorities;

jfr ~verk, ~uppbördsman; ~mål tax case;

omärke revenue (public treasury) stamp;

~mässig fiscal; from a fiscal (taxation) point

of view, from the point of view of taxation;

vid den yjnässiga beräkningen when assessing

the tax [on]; ~nedsättning tax reduction

(relief), abatement (lowering) of taxes;

~nämnd tax committee (board); ~objekt

object (subject) of taxation; ~omläggning

tax change (reform), change (reform) of

taxation; ~ordning system of taxation; operiod

fiscal period

skatteplikt tax liability; ~ig (om person) liable

to tax[ation] (pay tax[es]); (om varor etc.)

taxable, subject to tax, chargeable [with tax];

dutiable; Föreningen S~iga Bryggerier the

Swedish Association of Breweries Liable to Excise

Duty; o/g inkomst taxable (assessable) [net]

income; vara ~ig to have a taxable value

skatte i politik fiscal (tax[ation]) policy;

~procent rate [of taxation]; oredovisning tax

accounting; (av arbetsgivare äv.) [the]

accounting of P.A.Y.E. (Pay-As-You-Earn)

deductions ; ~reform fiscal (taxation) reform, reform

of taxation; progressiv ~ ref orm progressive

taxation reform; ~reglering tax adjustment;

~regleringsfond tax adjustment fund;

~reserv tax reserve, reserve for [income] tax;

(bokför.) tax contingency reserve (fund);

orestantier [income] tax arrears pl., unpaid

[balance of] taxes (rates); orestitution tax

refund, refund (repayment) of tax; ~rättslig

fiscal; ~ rättslig hemvist fiscal domicile; osats

rate of tax, tax rate; (Br äv.) rate poundage;

~skolk tax evasion (dodging); ~skolkare

tax evader (dodger); ~skruv tax-screw,

extortionate (grinding, burden of) taxation;

~skuld tax debt (liability), unpaid tax[es];

(i balansräkning äv.) accrued taxes; ~strejk

organized refusal to pay tax[es], organized

tax refusal; (äv,.) civil disobedience, passive

resistance; osynpunkt; ur (från) osynpunkt

from the fiscal point of view, for fiscal reasons;

~system tax system, system of taxation;

progressivt ~system [a] graduated system of

taxation; ~sänkning tax reduction (relief);

~säteri manor (country estate) subject to

taxation; ~tabell tax table; ~taxering tax

assessment; ~teknisk; enligt ~ teknisk

terminologi in (according to) fiscal terminology;

~teori theory of taxation; ~termin date

when a tax falls due; ~tidning; Svensk

S~tidning the Swedish Tax Journal; ~tillägg

additional tax; ~tryck pressure (burden) of

taxation; ~underlag basis of taxation, tax

basis, total revenue basis (amount,

foundation, source); ~uppbörd collection of

taxes, tax collection; ~uppbördsman tax

collector; (äv.) inspector of taxes, tax

inspector, revenue officer; ~uppbördsverk se

~verk; ~utjämning equalization (equation)

of taxes (rates); ~utjämningskonto taxation

equalization account; outredning review

(survey) of taxation [in Sweden], investigation

(inquiry) into taxation matters [in Sweden];

(utskott) [the] Government Commission on

Taxation; ~uträkning tax computation;

~verk tax ([inland; internal] revenue)

department (division, office, agency); (Br ung.)

Board of Inland Revenue, Inland Revenue

Office (Department, Commissioners); (US

ung.) [Federal] Bureau of Internal Revenue,

Internal Revenue Service (Bureau); [New

York] Tax Office; ~verkningar tax effects;

~vägran tax refusal, refusal to pay taxes;

(äv.) civil disobedience; ~värde ratable

(statlig taxable) value; ~väsen fiscal (tax)

system, system of taxation; jfr ~myndigheter;

~återbetalning tax refund, refund

(repayment) of tax[es]; ~återbäring tax refund;

oärenden tax[ation] (assessment) matters

(questions, issues); ~ökning se ~höjning;

~övervältring shifting of taxes, shifting [of]

the tax burden

skattkam mar|anvisning, ~bevis treasury

(exchequer) bond; the new 3 per cent. Exchequer

Stock 1962—63 offered at pp1,; ~e treasury;

(fig. äv.) mine [of information], storehouse;

~växel treasury (tidigare exchequer) hi\\\ (äv.)

treasury deposit receipt, (förk.) TDR; lån mot

säkerhet i ~ växlar loans secured by Treasury

bills; svenska statens ~växlar Swedish Treasury

bills

skatt|läggning (hist.: ung.) cadastration;

~mästare treasurer; (univ.) bursar;

sekreterare-y mästare (i förening) Secretary-Treasurer;

~ing (stat.) estimate, estimation; (försäkr.)

valuation; överstark yning (valfångst) over-

<< prev. page << föreg. sida << >> nästa sida >> next page >>