Full resolution (JPEG) - On this page / på denna sida - XI. Banking, Credit, and Insurance - 4. Savings-Banks and Similar Institutions. By [I. Flodström] Alfhild Lamm

<< prev. page << föreg. sida << >> nästa sida >> next page >>

Below is the raw OCR text

from the above scanned image.

Do you see an error? Proofread the page now!

Här nedan syns maskintolkade texten från faksimilbilden ovan.

Ser du något fel? Korrekturläs sidan nu!

This page has never been proofread. / Denna sida har aldrig korrekturlästs.

680

xi. banking, credit, and insurance.

with which the distribution to the funds was unable to keep even pace. —

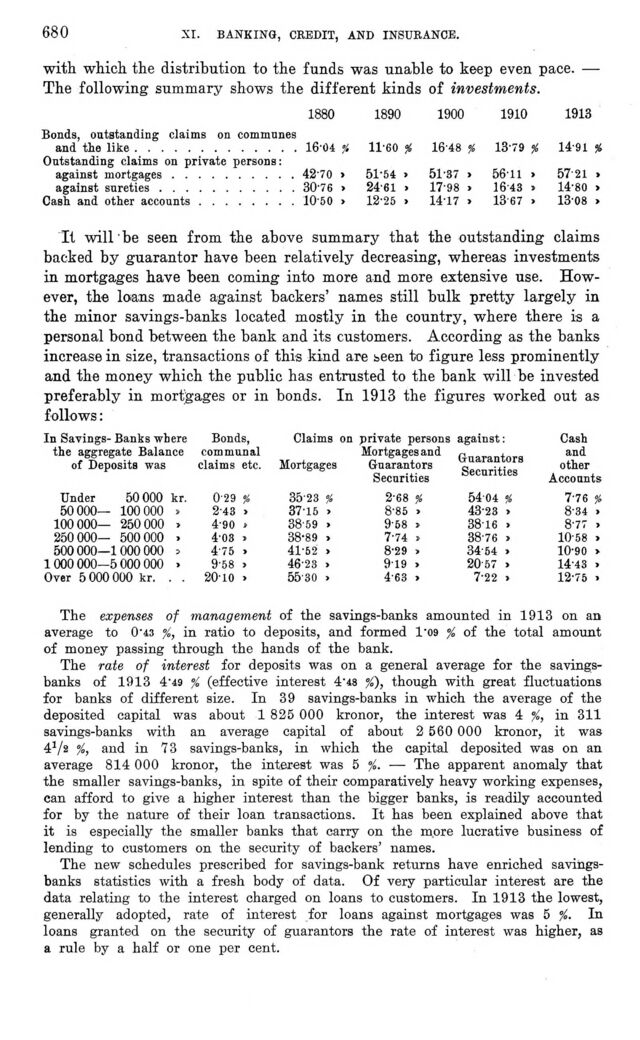

The following summary shows the different kinds of investments.

1880 1890 1900 1910 1913

Bonds, outstanding claims on communes and the like............. 16-04 a 11-60 % 16-48 % 13-79 % 14-91 %

Outstanding claims on private persons: against mortgages.......... 42-70 > 51-54 > 51-37 > 56-11 > 57-21 >

against sureties........... 30-76 > 24-61 > 17-98 > 16-43 » 14-80 >

Cash and other accounts........ 10-50 > 12-25 > 14-17 > 13 67 > 13-08 >

It will be seen from the above summary that the outstanding claims

backed by guarantor have been relatively decreasing, whereas investments

in mortgages have been coming into more and more extensive use.

However, the loians made against backers’ names still bulk pretty largely in

the minor savings-banks located mostly in the country, where there is a

personal bond between the bank and its customers. According as the banks

increase in size, transactions of this kind are seen to figure less prominently

and the money which the public has entrusted to the bank will be invested

preferably in mortgages or in bonds. In 1913 the figures worked out as

follows:

In Savings- Banks where the aggregate Balance of Deposits was Bonds, communal claims etc. Claims on Mortgages private persons Mortgages and Guarantors Securities against: Guarantors Securities Cash and other Accounts

Under 50 000 kr. 0-29 % 35-23 % 2-68 % 54 04 % 7-76 %

50 000— 100 000 » 2-43 > 37-15 » 8-85 » 43-23 > 8-34 >

100 000— 250 000 > 4-90 J 38-59 » 9-58 > 3816 » 8-77 >

250 000— 500 000 » 4-03 > 38-89 i 7-74 » 38-76 > 10-58 >

500 000—1000 000 3 4-75 > 41-52 > 8-29 » 34-54 » 10-90 >

1000 000-5 000 000 > 9-58 > 46-23 > 919 » 20-57 > 14-43 »

Over 5 000 000 kr. . . 2010 » 55-30 > 4-63 > 7-22 > 12-75 >

The expenses of management of the savings-banks amounted in 1913 on an

average to 0*43 %, in ratio to deposits, and formed 1"09 % of the total amount

of money passing through the hands of the bank.

The rate of interest for deposits was on a general average for the

savings-banks of 1913 4*49 % (effective interest 4*48 %), though with great fluctuations

for banks of different size. In 39 savings-banks in which the average of the

deposited capital was about 1 825 000 kronor, the interest was 4 in 311

savings-banks with an average capital of about 2 560 000 kronor, it was

41 /2 %, and in 73 savings-banks, in which the capital deposited was on an

average 814 000 kronor, the interest was 5 %. — The apparent anomaly that

the smaller savings-banks, in spite of their comparatively heavy working expenses,

can afford to give a higher interest than the bigger banks, is readily accounted

for by the nature of their loan transactions. It has been explained above that

it is especially the smaller banks that carry on the more lucrative business of

lending to customers on the security of backers’ names.

The new schedules prescribed for savings-bank returns have enriched

savings-banks statistics with a fresh body of data. Of very particular interest are the

data relating to the interest charged on loans to customers. In 1913 the lowest,

generally adopted, rate of interest for loans against mortgages was 5 %. In

loans granted on the security of guarantors the rate of interest was higher, as

a rule by a half or one per cent.

<< prev. page << föreg. sida << >> nästa sida >> next page >>