Full resolution (JPEG) - On this page / på denna sida - V. Social Movements - 1. Labour Questions and Social politics - Social Insurance

<< prev. page << föreg. sida << >> nästa sida >> next page >>

Below is the raw OCR text

from the above scanned image.

Do you see an error? Proofread the page now!

Här nedan syns maskintolkade texten från faksimilbilden ovan.

Ser du något fel? Korrekturläs sidan nu!

This page has never been proofread. / Denna sida har aldrig korrekturlästs.

old age and invalidity insurance.

727

ordained clergymen, and, moreover, the wives of all persons thus exempted.

Further, decision shall rest with Government whether, and under what

conditions, persons that are entitled to a pension on the ground of holding posts in

the public or in private service, or on the ground of insurance in a pension or

annuity establishment, shall be dispensed from the payment of fees.

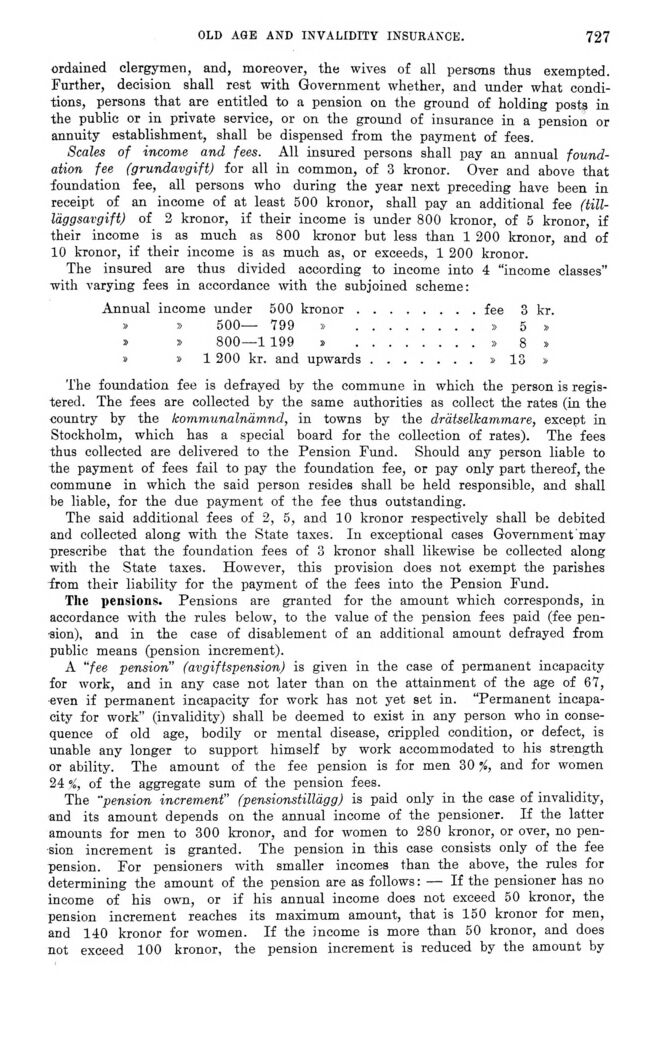

Scales of income and fees. All insured persons shall pay an annual

foundation fee (grundavgift) for all in common, of 3 kronor. Over and above that

foundation fee, all persons who during the year next preceding have been in

receipt of an income of at least 500 kronor, shall pay an additional fee

(till-läggsavgift) of 2 kronor, if their income is under 800 kronor, of 5 kronor, if

their income is as much as 800 kronor but less than 1 200 kronor, and of

10 kronor, if their income is as much as, or exceeds, 1 200 kronor.

The insured are thus divided according to income into 4 "income classes"

with varying fees in accordance with the subjoined scheme:

Annual income under 500 kronor........fee 3 kr.

» » 500— 799 » ........» 5 »

» » 800—1 199 » ........» 8 »

s » 1 200 kr. and upwards.......»13 »

The foundation fee is defrayed by the commune in which the person is

registered. The fees are collected by the same authorities as collect the rates (in the

country by the kommunalnämnd, in towns by the drätselkammare, except in

Stockholm, which has a special board for the collection of rates). The fees

thus collected are delivered to the Pension Fund. Should any person liable to

the payment of fees fail to pay the foundation fee, or pay only part thereof, the

commune in which the said person resides shall be held responsible, and shall

be liable, for the due payment of the fee thus outstanding.

The said additional fees of 2, 5, and 10 kronor respectively shall be debited

and collected along with the State taxes. In exceptional cases Government may

prescribe that the foundation fees of 3 kronor shall likewise be collected along

with the State taxes. However, this provision does not exempt the parishes

from their liability for the payment of the fees into the Pension Fund.

Tlie pensions. Pensions are granted for the amount which corresponds, in

accordance with the rules below, to the value of the pension fees paid (fee

pension), and in the case of disablement of an additional amount defrayed from

public means (pension increment).

A "fee pension" (avgiftspension) is given in the case of permanent incapacity

for work, and in any case not later than on the attainment of the age of 67,

■even if permanent incapacity for work has not yet set in. "Permanent

incapacity for work" (invalidity) shall be deemed to exist in any person who in

consequence of old age, bodily or mental disease, crippled condition, or defect, is

unable any longer to support himself by work accommodated to his strength

or ability. The amount of the fee pension is for men 30 %, and for women

24 of the aggregate sum of the pension fees.

The "pension increment" (pensionstillägg) is paid only in the case of invalidity,

and its amount depends on the annual income of the pensioner. If the latter

amounts for men to 300 kronor, and for women to 280 kronor, or over, no

pension increment is granted. The pension in this case consists only of the fee

pension. For pensioners with smaller incomes than the above, the rules for

determining the amount of the pension are as follows: — If the pensioner has no

income of his own, or if his annual income does not exceed 50 kronor, the

pension increment reaches its maximum amount, that is 150 kronor for men,

and 140 kronor for women. If the income is more than 50 kronor, and does

not exceed 100 kronor, the pension increment is reduced by the amount by

<< prev. page << föreg. sida << >> nästa sida >> next page >>