Full resolution (JPEG)

- On this page / på denna sida

- Finances, by J. J. Woxen

<< prev. page << föreg. sida << >> nästa sida >> next page >>

Below is the raw OCR text

from the above scanned image.

Do you see an error? Proofread the page now!

Här nedan syns maskintolkade texten från faksimilbilden ovan.

Ser du något fel? Korrekturläs sidan nu!

This page has been proofread at least once.

(diff)

(history)

Denna sida har korrekturlästs minst en gång.

(skillnad)

(historik)

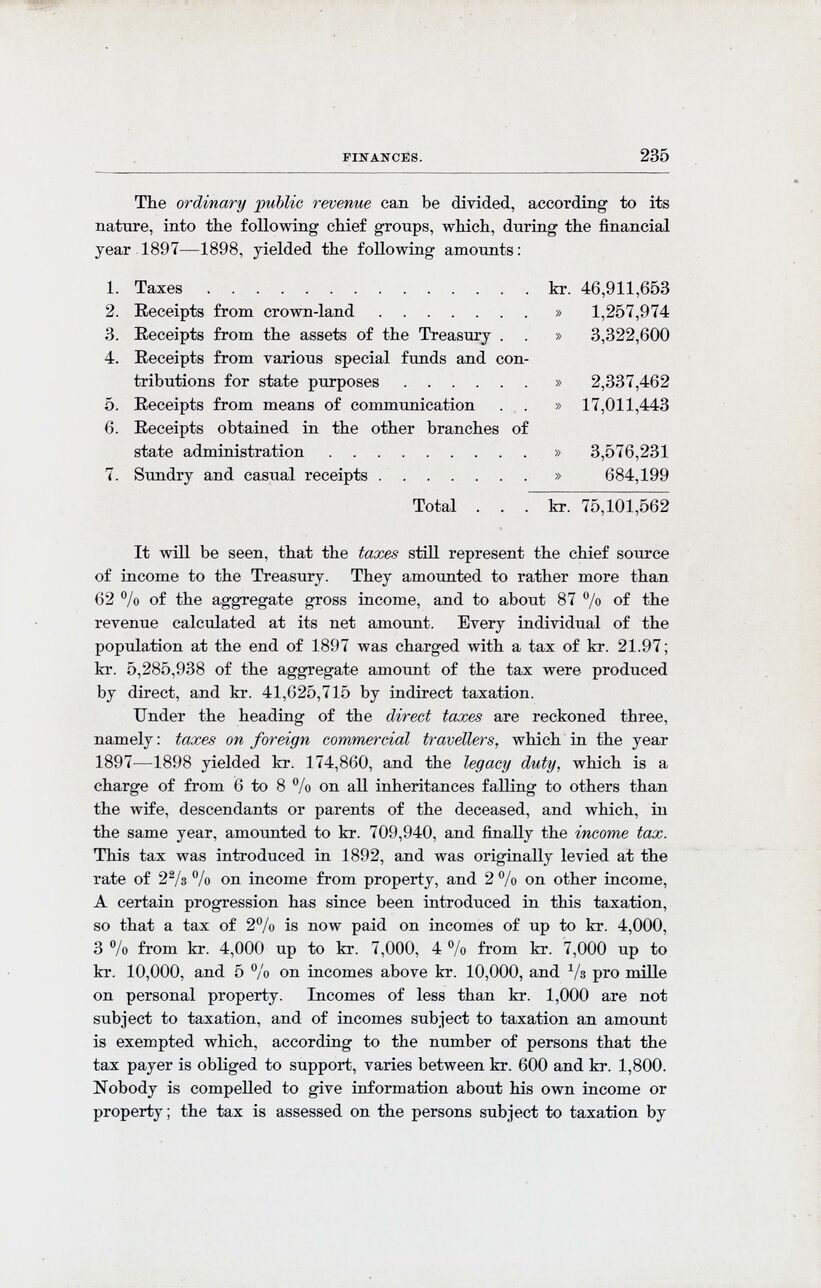

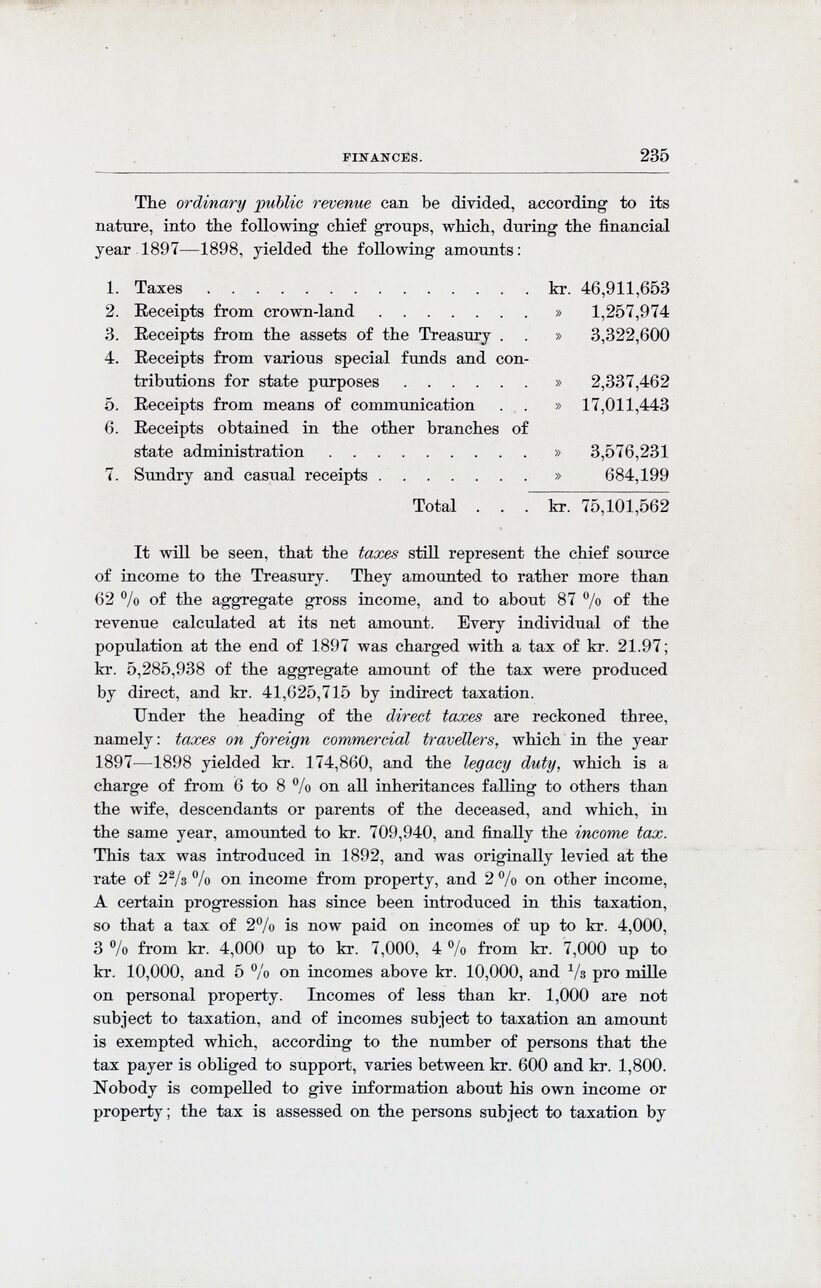

The ordinary public revenue can he divided, according to its

nature, into the following chief groups, which, during the financial

year 1897—1898, yielded the following amounts:

| 1. Taxes .............. | kr. | 46,911,653 |

| 2. Receipts from crown-land ....... | » | 1,257,974 |

| 3. Receipts from the assets of the Treasury . . | » | 3,322,600 |

4. Receipts from various special funds and

contributions for state purposes ...... | » | 2,337,462 |

| 5. Receipts from means of communication . . | » | 17,011,443 |

6. Receipts obtained in the other branches of

state administration ......... | » | 3,576,231 |

| 7. Sundry and casual receipts ....... | » | 684,199 |

| Total . . . | kr. | 75,101,562 |

It will be seen, that the taxes still represent the chief source

of income to the Treasury. They amounted to rather more than

62 % of the aggregate gross income, and to about 87 % the

revenue calculated at its net amount. Every individual of the

population at the end of 1897 was charged with a tax of kr. 21.97;

kr. 5,285,938 of the aggregate amount of the tax were produced

by direct, and kr. 41,626,715 by indirect taxation.

Under the heading of the direct taxes are reckoned three,

namely: taxes on foreign commercial travellers, which in the year

1897—1898 yielded kr. 174,860, and the legacy duty, which is a

charge of from 6 to 8 % on all inheritances falling to others than

the wife, descendants or parents of the deceased, and which, in

the same year, amounted to kr. 709,940, and finally the income tax.

This tax was introduced in 1892, and was originally levied at the

rate of 2 ⅔ % on income from property, and 2 % on other income,

A certain progression has since been introduced in this taxation,

so that a tax of 2 % is now paid on incomes of up to kr. 4,000,

3 % from kr. 4,000 up to kr. 7,000, 4 % from kr. 7,000 up to

kr. 10,000, and 5 % on incomes above kr. 10,000, and ⅓ pro mille

on personal property. Incomes of less than kr. 1,000 are not

subject to taxation, and of incomes subject to taxation an amount

is exempted which, according to the number of persons that the

tax payer is obliged to support, varies between kr. 600 and kr. 1,800.

Nobody is compelled to give information about his own income or

property; the tax is assessed on the persons subject to taxation by

<< prev. page << föreg. sida << >> nästa sida >> next page >>

Project Runeberg, Tue Mar 11 10:44:48 2025

(aronsson)

(diff)

(history)

(download)

<< Previous

Next >>

https://runeberg.org/norparis/0247.html